What a difference a few years makes. Duke of Data Andy Yan was working with Bing Thom Architects in 2015 when he released his research on who was buying real estate in Vancouver. Andy researched the land titles and tracked the purchasers who had “non-Anglicised Chinese names”. Tracking for a six month period from September 2014 to March 2015, Andy found that 75 per cent of all property transactions involved buyers with these non-Anglicised names, suggesting that those individuals may be foreign buyers.

At the time, as Terry Glavin’s article in Macleans Magazine notes, this urban planner from East Vancouver was vilified as his work “broke a taboo that was enforced so absurdly that Vancouver mayor Gregor Robertson resorted to dismissing Yan’s research as racist.” Problem was that Andy Yan was right. Banks were also complicit in the “manipulation of clandestine back channels around China’s currency control regulations—the same routes that well-connected Chinese multi-millionaires have been using to shift up to a trillion dollars’ worth of yuan out of China every year.” And a lot of these new home owners didn’t really have occupations, other than being a homemaker.

Andy is also disarmingly in the moment and has an interesting way of using words. As he says “So you had these whispers about racism being used to shut down a dialogue about affordability and the kind of city we want to build here. It’s a kind of moral signalling to camouflage immoral actions. It’s opportunism, and it’s a cover for the tremendous injustices that are emerging in the City of Vancouver and across the region. It’s a weird Vancouver thing. It’s very annoying. It’s kale in the smoothies or something…I’m always careful about using biomedical analogies but what was like a little skin ailment, if you will, over the last 10 or 15 years, has become a full-fledged cancer… The top two expenditures of any Canadian household is shelter and transportation. God help you if you factor in child care.”

With Transparency International estimating that half of Vancouver’s most costly properties are owned by shell companies or trusts, another 20,000 homes sit vacant. Andy Yan also worries about Air BnB which takes up rental housing and is now going to be required to pay sales and municipal taxes.“That’s like taxing cigarettes to pay for lung cancer treatments.”

You can read the whole article here that also discusses the municipal and provincial involvement of real estate companies and property developers who benefited in the rise of real estate prices. Andy does make some recommendations such as taxes to stop property flipping and closing the bare trust loopholes that allow properties to be hidden in numbered companies, something Ontario squelched over thirty years ago. Now the Director of the City Program at Simon Fraser University, Andy Yan observes ““We need to go back to civic virtues.We need to talk about the sacrifices we are willing and we need to make for the greater good of the community. We need to have a discussion about what the public good is, and what we are willing to sacrifice to make it happen.”

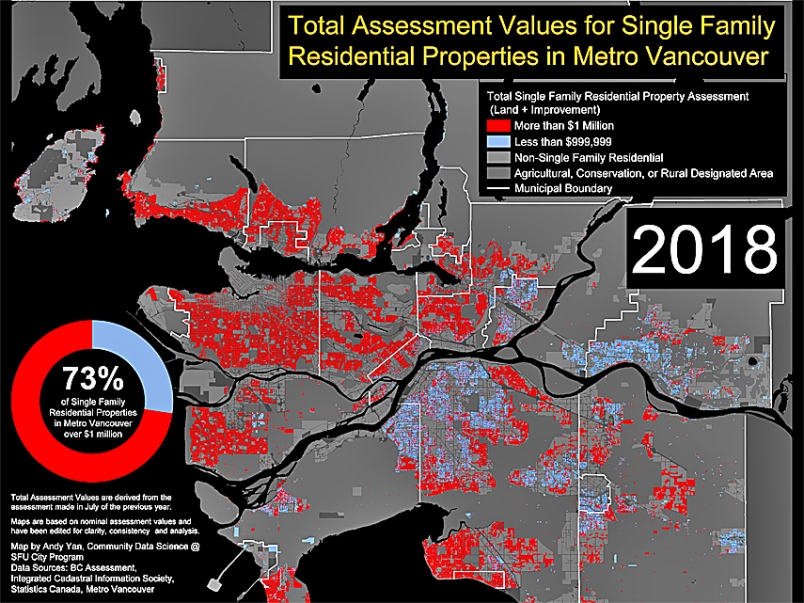

Andy Yan image

Andy Yan image

Robertson’s quote referenced was definitely his “jumped the shark” moment, and why he’s not running again. Everyone realized how out of touch he was and not willing to rock the cozy developer-politician axis.

Bravo to those like Andy Yan and Kerry Gold who have braved the taunts of racism and exposed the rot at the core of Vancouver’s real estate market.

Unfortunately, the “non-Anglicized Chinese names” discussion created a stereotype that branded anyone with this type of name. Back when I was building custom houses in the 2000s, I had clients with “non-Anglicized names”, who were Canadian citizens, and had to use their born names for legal purposes on contracts and land title transactions. They are no more “foreign investors” than Andy Yan is.

That is not to say that there is no validity in Mr. Yan’s research. But as with much of the dialogue regarding housing in Vancouver, there is a rush to simplify the problem, and therefore seek a simple, ‘silver bullet’ answer. This debate does not recognize the complexity of the market, with all of its segments delineated by geography, price, housing type and demographics/target markets. Basic economics would suggest that price escalation can only be remedied by addressing both supply and demand elements, to the extent that we can influence the various components of each.

I don’t believe that our housing affordability issues will be solved by eliminating foreign purchasers from one specific country, if that is even possible.

Since you had an inside seat, perhaps you can enlighten us as to where that money came from to build those houses? I doubt it was earned anywhere in BC.

It is quite amazing that foreign money is taking all the attention away from basic economic laws of supply and demand, the pumping of the world and local economy by record cheap credit, from a land shortage exacerbated by outdated land use planning, from the invisible mass of local wealth passing from one generation to another in the form of inheritances, from the natural higher price of attractive neighbourhoods, from the natural escalation in land value of everyday development, from the varying rates of demand associated with specific housing types, from correcting the lack of diversity in housing type, from the high price placed on intangibles like mountain and ocean views, and so forth.